Best Travel Apps for Budget Tracking

Trip Cost Tracking: A Necessity for Budget-Conscious Travelers

Planning a trip often involves meticulous budgeting, and tracking expenses is crucial for maintaining a realistic financial plan. Trip cost tracking apps provide a streamlined way to record every expenditure, from flights and accommodation to meals and souvenirs. This allows you to monitor your spending in real-time, identify areas where you might be overspending, and adjust your budget accordingly, ensuring a more enjoyable and financially responsible trip experience. This functionality is particularly vital for budget travelers and those on tight financial constraints.

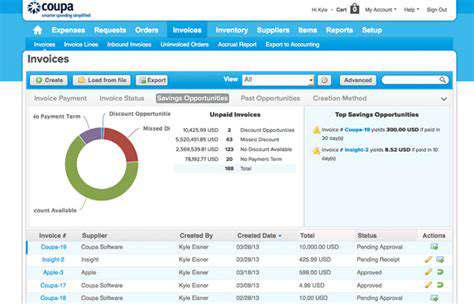

Beyond the core function of recording expenses, many apps offer insightful visualizations of your spending patterns. These visualizations can highlight spending trends, helping you understand where your money is going and identify potential areas for savings. By regularly reviewing your spending data, you can make informed decisions about future trips and develop more effective budgeting strategies.

Expense Categorization for Effective Analysis

A robust trip cost tracking app should allow for the categorization of expenses. This feature enables detailed analysis of spending in various categories, such as accommodation, transportation, food, activities, and souvenirs. With categorized data, you can pinpoint areas where you're allocating more or less funds than anticipated, allowing for adjustments to your spending habits and ensuring you stay within your budget.

Integration with Payment Methods for Seamless Recording

Seamless integration with your preferred payment methods is a key feature of a user-friendly trip cost tracking app. This integration allows for automatic or manual recording of transactions, saving you time and effort while ensuring accuracy. This direct connection to your bank accounts or credit cards eliminates manual data entry, reducing the chances of errors and providing a more efficient experience. Many apps also offer the ability to import transactions from your bank statements, further simplifying the process.

This integration not only saves time but also enhances data accuracy, which is vital for creating a precise and reliable record of your trip expenses.

Receipt Scanning for Effortless Expense Input

Modern trip cost tracking apps often include receipt scanning features. This functionality allows for quick and easy input of expenses by simply scanning the receipt with your smartphone's camera. This eliminates the need for manual data entry, which is prone to errors, and saves precious time while ensuring that all expenses are accurately recorded. This feature is particularly helpful for travelers who prefer a more automated and efficient way of tracking their expenses.

Real-Time Expense Monitoring and Budget Tracking

The ability to monitor your expenses in real-time is a critical feature for effective budget management during your trip. A good app will provide real-time updates on your spending, allowing you to see how your current expenses compare to your budget. This real-time visibility empowers you to make informed decisions and adjust your spending if necessary, ensuring you stay within your predefined financial limits.

Visualizations and Reporting for Comprehensive Insights

Beyond basic expense tracking, a useful app should offer various visualizations and reports to provide a comprehensive understanding of your spending. These visualizations can illustrate spending trends, highlight overspending in specific categories, and identify areas where you can potentially save money. Graphical representations, charts, and graphs provide valuable insights into your spending patterns, empowering you to make data-driven decisions about future travel plans.

Currency Conversion and Exchange Rate Tracking for International Travel

For international trips, currency conversion is an essential aspect of expense tracking. A good app should automatically convert expenses to your home currency, simplifying the process of comparing costs across different countries. Furthermore, real-time exchange rate tracking ensures that you have the most up-to-date information, helping you make informed decisions about your spending. This feature is particularly important for travelers venturing into different currencies, ensuring a smoother and more precise understanding of their expenses.

Travel Reward & Point Tracking Integration

Understanding the Benefits of Travel Reward Integration

Integrating travel reward programs into your budget tracking app can significantly boost your savings potential. By automatically linking your rewards accounts, you can easily see how points earned from flights, hotels, and other travel expenses can be redeemed for future trips. This streamlined approach allows you to proactively manage your rewards and track their value in real-time, ensuring you're maximizing the return on your travel spending.

Furthermore, the integration can help you identify patterns in your spending and rewards earning. This insight can assist in making informed decisions about future travel plans and maximizing your rewards potential. Seeing how your spending aligns with reward programs can help you uncover opportunities to save more and earn more, leading to more affordable and rewarding travel experiences.

Tracking Points Across Multiple Platforms

One of the most significant advantages of a travel reward integration is the ability to consolidate your points across multiple platforms. This eliminates the need for manual tracking and reconciliation, saving valuable time and effort. Imagine easily seeing your total accumulated points from various airlines, hotel chains, and credit cards in one central location. This centralized view allows for a more comprehensive picture of your travel rewards, enabling you to make smarter decisions about spending and redemption strategies.

This consolidated tracking also makes it easier to identify potential synergies between different programs. You might find that booking a hotel through a specific rewards program earns you enough points to cover a significant portion of your flight costs, leading to more substantial savings. A robust integration helps you uncover these hidden opportunities and make the most of your accumulated rewards.

Automated Redemption and Booking Capabilities

Advanced travel reward integration apps often offer automated redemption capabilities, allowing you to seamlessly convert points into travel credits or discounts. This feature streamlines the process of redeeming your hard-earned points, saving you from the hassle of manually navigating redemption portals. Imagine automatically applying your points to your next flight booking or hotel reservation – this automated process saves you time and effort, allowing you to focus on planning your dream trip.

Personalized Recommendations and Savings Alerts

A well-designed travel reward integration app can provide personalized recommendations based on your travel history and preferences. These recommendations can help you identify optimal redemption opportunities and suggest ways to maximize your rewards. This personalized approach allows you to make more informed decisions about your travel spending and enhance your overall return on investment. The app can also send you timely alerts when significant redemption opportunities arise, helping you stay informed and proactive in managing your travel rewards.

Integration with Existing Budgeting Tools

A seamless integration with existing budgeting tools is crucial for effective travel planning and expense management. This allows you to track your travel expenses alongside other personal finances, providing a holistic view of your spending habits and financial health. This comprehensive approach ensures you maintain control over your budget while effectively leveraging travel rewards. Such integration can be especially beneficial when budgeting for major trips, as you can accurately estimate expenses and plan your spending accordingly.

The integration of travel reward programs with your budgeting tools makes it possible to view how your travel spending affects your overall financial goals. This visibility enables you to adapt your travel plans and spending habits to stay within your budget while maximizing your travel rewards.

Budgeting Tools & Trip Planning for Optimal Financial Management

Choosing the Right Budgeting Tool

Selecting a budgeting tool is crucial for successful trip planning. Consider factors like ease of use, features like expense tracking, and the ability to create and manage budgets. Some tools offer integration with travel booking platforms, making the entire process seamless. A user-friendly interface is essential for consistently tracking your spending and sticking to your pre-determined budget.

Expense Tracking for Accountability

Detailed expense tracking is vital for understanding where your money goes. Tools that allow categorizing expenses by category (e.g., accommodation, food, activities) provide valuable insights into spending patterns. This helps you identify areas where you might be overspending and adjust your budget accordingly.

Creating Realistic Trip Budgets

Effective trip planning involves creating a realistic budget that accounts for all anticipated expenses. This includes not only accommodation and transportation costs but also food, activities, and potential unforeseen circumstances. Thorough research and realistic estimations are key to avoiding financial surprises during your trip.

Defining Trip Goals and Priorities

Before diving into budgeting, clearly define your trip goals and priorities. Are you seeking a luxurious vacation, a budget-friendly adventure, or a cultural immersion experience? Understanding your intentions will help you establish realistic budget parameters. This step involves considering factors like desired activities, desired level of comfort, and the number of days you plan to spend traveling.

Utilizing Travel Booking Platforms

Several travel booking platforms offer integrated budgeting tools. These platforms often facilitate the comparison of prices and booking options, allowing you to optimize your spending. Many platforms provide tools for tracking expenses related to flights, accommodations, and tours. This integration streamlines the process of planning and managing your budget during your trip.

Leveraging Travel Apps for Trip Planning

Mobile travel apps can significantly simplify trip planning. They often provide features for tracking expenses, creating budgets, and managing travel documents. These apps offer a convenient way to manage your finances while on the go. Utilizing these apps can be particularly helpful for staying organized and on budget while traveling.

Building a Flexible Contingency Fund

While meticulous budgeting is important, unexpected expenses are inevitable. Building a flexible contingency fund dedicated to unforeseen circumstances is crucial. This fund can cover potential issues like lost luggage, medical emergencies, or unexpected delays. Having a contingency fund provides peace of mind and allows you to adapt to unforeseen situations without derailing your entire budget.

![How to Learn Basic Phrases for [Specific Language, e.g., Japanese]](/static/images/27/2025-07/EssentialGreetingsandIntroductionsinJapanese.jpg)