Customs Rules for Bringing Electronics When Traveling

Different Legal Systems Across the Globe

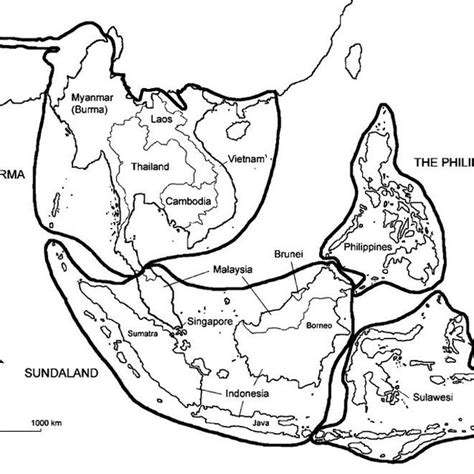

Grasping the nuances of legal frameworks is vital for professionals operating across borders. No two nations share identical legal structures, with each crafting its own tapestry of statutes, regulations, and court procedures that shape international commerce. Mastering these distinctions demands more than surface-level knowledge—it requires immersion in each jurisdiction's legal culture, from its foundational principles to its enforcement practices. Savvy operators always engage local legal experts before making cross-border commitments.

Legislative approaches vary dramatically worldwide. While some nations bind judges tightly to written codes, others empower courts to shape law through accumulated rulings. These philosophical differences don't just influence legal theory—they directly affect how disputes get resolved in practice.

Common Law vs. Civil Law Traditions

The legal world divides largely between two historic traditions. In common law jurisdictions like the UK and US, judicial decisions form living legal precedents that evolve with each new case. This creates dynamic legal systems that adapt to changing circumstances, though sometimes at the cost of consistency across regions.

Civil law nations like France and Germany anchor their systems to comprehensive legal codes, treating judicial decisions as applications rather than sources of law. While this offers clearer predictability, it can make the law less responsive to societal shifts unless legislators actively update the codes.

Property Rights Frameworks

Real estate and asset ownership rules reveal striking global diversity. For international investors, overlooking these differences can transform straightforward deals into legal nightmares, especially when dealing with land rights, inheritance laws, or title transfers. Some countries maintain complex restrictions on foreign ownership, while others impose unique taxation structures.

Consider how Middle Eastern leasehold systems differ from Western freehold models, or how Asian family property concepts contrast with individual ownership norms. Each framework carries implications for investment security and exit strategies.

Contract Enforcement Landscapes

An agreement binding in New York might unravel in New Delhi without proper jurisdictional planning. International contracts must account for varying requirements regarding offer/acceptance, consideration, and capacity across legal systems. More critically, the remedies available for breach differ dramatically—some courts award specific performance while others limit relief to monetary damages.

Language choices matter too. Many jurisdictions enforce contracts only in local languages, and translation errors have derailed major deals. The smartest negotiators build in multi-step dispute clauses accounting for regional enforcement realities.

Resolving Cross-Border Disputes

When international agreements falter, resolution pathways diverge sharply by region. Litigation timelines vary from months to decades depending on court backlogs. Some Asian jurisdictions still view lawsuits as relationship failures, while Western courts embrace adversarial proceedings.

The rise of international arbitration centers has created new options, but enforceability remains patchy—a 2022 study showed 37% of awards face challenges in local courts. Savvy operators now combine arbitration clauses with pre-agreed enforcement mechanisms in multiple jurisdictions.

Intellectual Property Realities

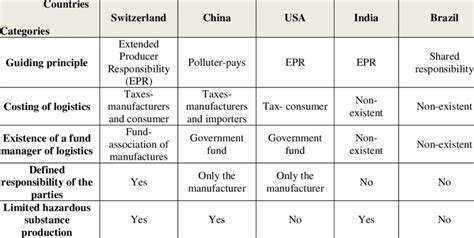

IP protection resembles a global patchwork quilt—full of holes and uneven stitching. China's first-to-file system contrasts sharply with America's first-to-invent approach for patents. Some jurisdictions barely recognize software patents, while others extend copyright terms beyond creator lifespans.

The most dangerous trap? Assuming registration in one country confers global protection. Major brands learn this painfully when counterfeit operations exploit jurisdictional gaps. Forward-thinking companies now implement IP mapping strategies tailored to each market's unique protections and enforcement realities.