Tips for Renting an Apartment vs Hotel for Longer Stays

Analyzing Hotel Stays for Extended Stays

Understanding Extended Stays

Extended stays, encompassing more than a typical overnight visit, are increasingly popular for various reasons, from business travel to personal relocation. Analyzing these extended stays allows hotels to better understand their clientele's needs and preferences, offering tailored services and packages to maximize revenue and guest satisfaction. This in-depth analysis can provide valuable insights into guest behavior and help hotels optimize their operations for long-term stays.

Understanding the motivations behind extended stays is crucial. Are guests primarily relocating for work, family reasons, or other personal circumstances? This information helps tailor marketing strategies and room offerings to attract and retain these valuable guests. Knowing their needs will directly impact the hotel's ability to cater to their specific requirements.

Factors Influencing Extended Stay Decisions

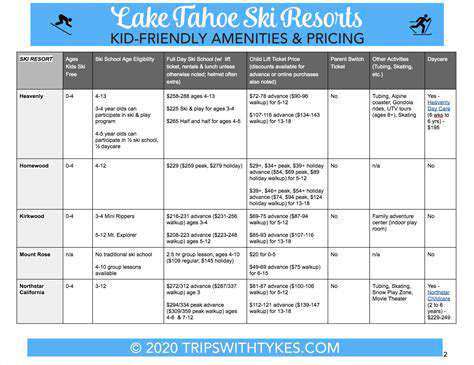

Numerous factors influence guests' decision to opt for extended stays. These include the availability of amenities specifically designed for extended stays, such as kitchens, laundry facilities, and flexible contracts. The proximity to work, family, or other important locations also plays a significant role. Understanding these factors is essential for hotels to effectively market their facilities to potential extended stay guests.

Price points also play a crucial role in attracting extended stay guests. Competitive rates relative to other accommodations, and the inclusion of all-inclusive packages, can significantly impact booking decisions. Hotels must strategically analyze pricing models to maximize profitability while remaining competitive.

Revenue Maximization Strategies

By analyzing data on extended stays, hotels can refine their revenue maximization strategies. This includes offering special packages for extended stays, providing discounts, or creating exclusive amenities for these guests. Identifying the specific needs and preferences of extended stay guests can enable the development of customized packages and services.

Analyzing guest feedback and reviews is an integral part of improving the guest experience. This data can reveal areas for improvement in room amenities, service quality, and overall hotel facilities. This continuous feedback loop is essential for maintaining a high level of satisfaction and encouraging repeat business.

Guest Preferences and Amenities

A crucial aspect of analyzing extended stays is recognizing the unique preferences of extended-stay guests. These guests often prioritize amenities like kitchens, laundry facilities, and flexible contract options. Hotels can cater to these specific needs by incorporating these features into their room offerings or providing access to them on-site. This targeted approach can significantly boost satisfaction and occupancy rates for extended-stay accommodations.

Understanding the length of stays is also important. Are guests staying for weeks, months, or even longer? This information helps hotels determine the optimal room pricing and amenities for different stay durations. Tailoring amenities and services to suit various stay lengths allows hotels to offer a more personalized experience.

Comparing Costs and Amenities

Understanding the Baseline

When comparing costs and amenities, it's crucial to establish a baseline. This baseline should consider the essential needs and wants of the individuals or families involved. Defining these needs and wants upfront will help in making informed decisions throughout the comparison process. A clear understanding of the baseline is fundamental to a successful cost-benefit analysis.

A baseline approach also considers the geographical location, market conditions, and individual preferences to ensure a fair comparison. This will allow for a more accurate evaluation of the costs and amenities available in various options.

Analyzing Housing Costs

Housing costs are a significant factor in any comparison. This includes not only the initial purchase price but also ongoing expenses like property taxes, insurance, and potential maintenance costs. Different housing options will have varying levels of associated costs, so understanding each component is essential for a complete picture.

Homeowners should also factor in potential increases in property taxes and insurance rates over time, as these can significantly impact long-term financial planning. Understanding the potential fluctuation in these costs is important.

Evaluating Utility Expenses

Utility costs, including electricity, water, and gas, can vary significantly depending on factors such as climate, energy efficiency of the property, and usage habits. Comparing these costs across different options is critical in understanding the true financial picture.

Understanding the historical utility costs of each location is essential. This will allow a more comprehensive comparison and aid in predicting future expenses. This is an important factor that is often overlooked.

Assessing Amenities and Services

The availability and quality of amenities and services are often a key factor in determining the overall value of a place. Factors such as proximity to schools, parks, shopping centers, and public transportation should be considered.

The quality of local services like healthcare and emergency response can also influence a decision. Investigating these factors and their costs is crucial for a full evaluation.

Considering Lifestyle Considerations

Beyond the financial aspects, consider the lifestyle you hope to have. Think about the type of community you desire and the level of activity you prefer. Does the location offer opportunities for recreation, entertainment, or cultural events that align with your preferences?

The overall atmosphere and sense of community are important aspects to consider when making a choice.

Investigating Potential Tax Benefits

Certain housing options might offer tax benefits that could substantially reduce the overall cost of ownership. Researching these tax advantages and how they may impact your personal financial situation is worthwhile.

Comparing Value and Return on Investment

Ultimately, the comparison should focus on the overall value and return on investment. Consider the long-term financial implications of each option, including the potential for appreciation or depreciation of property value.

A thorough analysis should consider both the immediate and future costs and benefits. This will help determine the most suitable option that aligns with your financial goals.

![How to Use Airport Lounges [Even Without Business Class]](/static/images/27/2025-06/StrategicPartnershipsandGuestPasses.jpg)

![Guide to Visa on Arrival [Where & How It Works]](/static/images/27/2025-06/EssentialDocumentsforVisaonArrival.jpg)