Understanding Exit Taxes When Leaving a Country

Identifying Your Potential Tax Liability

Understanding the Different Types of Exit Taxes

Exit taxes represent a multifaceted aspect of taxation, with various categories governed by distinct rules. Grasping these differences is paramount when evaluating your obligations. Some taxes apply to assets being withdrawn from a business, while others target income from interest sales or transfers. Each scenario demands careful analysis of your specific circumstances.

A critical distinction exists between taxes on share sales versus those on resulting income. The former may depend on asset values, while the latter could relate to profit margins. Identifying which applies to your situation forms the foundation of sound financial planning and helps prevent unexpected complications.

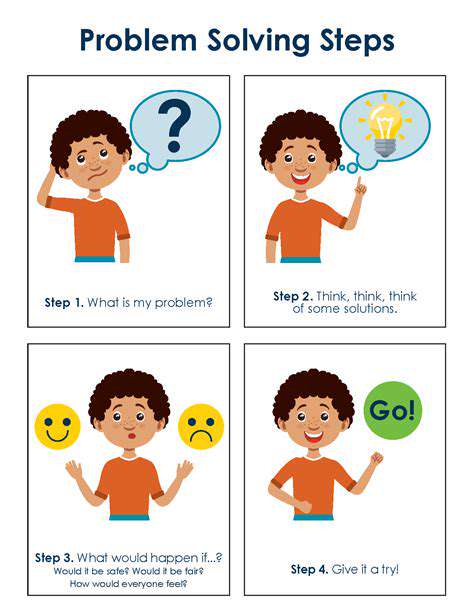

Calculating the Taxable Amount

Determining your exact taxable sum requires meticulous attention to detail. This process involves analyzing sale prices, potential deductions, and relevant tax legislation. Maintaining comprehensive records - including investment histories, asset valuations, and deduction documentation - proves essential for accurate computations. Errors in these calculations might lead to substantial financial consequences.

Factors like depreciation and amortization often necessitate complex calculations. Engaging a qualified tax professional can prove invaluable when navigating these intricate financial adjustments and ensuring precise tax assessments.

Factors Influencing Your Tax Liability

Multiple elements affect potential tax obligations during business exits. These include chosen exit methods (share sales, buyouts) and jurisdictional tax laws. Key considerations involve transaction dates and whether income qualifies as capital or ordinary. Awareness of these variables helps anticipate tax burdens more accurately.

Jurisdictional differences between company locations and personal residences often create complex tax scenarios. Overlooking these variations might result in significant unanticipated liabilities.

Tax Implications of Different Exit Strategies

Exit methods carry distinct tax consequences. Share sales typically incur different tax treatments than buyouts or alternative arrangements. Comparing tax rates and deduction opportunities across options enables more informed decision-making. Each strategy may trigger unique reporting requirements and documentation standards.

Professional guidance becomes particularly valuable when evaluating how various exit approaches align with financial objectives while meeting tax obligations.

Seeking Professional Tax Advice

Exit tax complexities often demand specialized expertise. Consulting a qualified tax advisor provides customized guidance tailored to individual circumstances. These professionals help interpret regulations, identify applicable deductions, and prepare necessary filings.

Proactive engagement with tax specialists can prevent costly errors and facilitate compliant, streamlined exit processes.

Types of Assets Subject to Exit Taxes

Tangible Assets

Tangible assets constitute physical property with observable value, including equipment, machinery, real estate, and vehicles. These resources typically depreciate over their operational lifespan, affecting both financial reporting and exit taxation. Sales or transfers often involve complex negotiations encompassing pricing, terms, and tax considerations.

Market conditions, demand fluctuations, and asset conditions significantly influence valuations. Comprehensive appraisals and due diligence prove essential for establishing fair market values. Maintaining detailed ownership and maintenance records prevents disputes and facilitates smoother transactions.

When assets serve as loan collateral, exit strategies must account for these financial obligations and their potential impact on final agreements.

Intangible Assets

Non-physical assets like patents, trademarks, and goodwill represent substantial but less quantifiable business value. These intellectual properties frequently generate future revenue streams, warranting careful evaluation during exits. Their valuation requires specialized expertise and market trend analysis.

Transferring intangible assets often involves complex legal arrangements like licensing agreements or intellectual property sales. Clear documentation in legal contracts ensures all parties understand rights and responsibilities, preventing future disputes.

Protecting intangible assets through proper legal channels maintains their value and facilitates smoother transitions during business exits.