Understanding Customs Duties and Taxes on Imported Goods

Types of Import Duties and Taxes

Ad Valorem Duties

Ad valorem duties are import taxes calculated as a percentage of the value of the imported goods. This method is a common and straightforward way to levy import taxes, as it directly ties the tax amount to the assessed value of the imported item. This allows for a relatively predictable tax burden for importers, assuming the assessed value is accurate. Importantly, ad valorem duties can be adjusted to account for fluctuations in market prices and economic conditions, ensuring that the tax burden remains relevant. The percentage applied can vary significantly across different products and countries, reflecting factors like domestic industry protection or revenue generation needs. This type of duty is widely used globally.

The calculation of the ad valorem duty is typically based on the declared value of the goods by the importer. Accurate and transparent declaration is crucial to avoid disputes and ensure compliance with import regulations. Accurate valuation plays a significant role in ensuring the fair and equitable application of the tax. Different factors might influence the import duty calculation, such as the classification of the goods under the relevant tariff schedule.

Specific Duties

Unlike ad valorem duties, specific duties are levied based on the physical characteristics of the imported goods, such as weight, volume, or quantity. This method of taxation is often applied to commodities like petroleum products, minerals, or agricultural products. Specific duties are generally easier to administer for certain goods, as the calculation is based on readily quantifiable characteristics. This predictability can be beneficial for importers and governments alike. This method can be effective in protecting domestic industries producing similar goods, ensuring a level playing field.

Specific duties can sometimes be more advantageous for importers of products in bulk. The fixed rate per unit of measurement simplifies the calculation process. This approach can be very efficient when the volume of imports is substantial.

Compound Duties

Compound duties combine elements of both ad valorem and specific duties. This approach involves applying both a percentage-based tax and a fixed charge per unit. This method is often used when assessing the value of imported goods, ensuring a comprehensive approach to taxation. This can be a complex method to implement and understand, requiring careful consideration of the specific details of the imported goods. The impact of compound duties on the overall cost of imports can vary significantly depending on the assessed value and the specific characteristics of the goods.

Mixed Duties

Mixed duties are a combination of different import duties, often tailored to specific products or industries. These duties can be complex and require careful interpretation of relevant import regulations. The flexibility of mixed duties allows governments to set different rates based on various factors, such as the origin of the goods, the specific characteristics of the product or the intended use. This method is often used to achieve targeted policy objectives, like supporting domestic producers or managing specific imports.

Import duty structures can vary greatly from one country to another, often reflecting distinct economic and political goals. Importantly, the complexity of mixed duties can lead to administrative challenges. A thorough understanding of the specifics is vital for importers to comply effectively.

Anti-Dumping Duties

Anti-dumping duties are imposed on imported goods when they are sold at a price below their normal value in the exporting country. These duties are designed to protect domestic industries from unfair pricing practices and safeguard fair competition in the market. This type of duty is often implemented in response to complaints about unfair trade practices by foreign producers. The imposition of anti-dumping duties can be a complex process, often involving investigations and legal challenges. Often, these investigations can take significant time and resources.

These duties are critical for maintaining a level playing field in international trade. Importantly, these specific duties are not applied uniformly across all products and can vary significantly depending on the specific context.

Factors Affecting Import Duty and Tax Calculations

Valuation Methods

Import duty and tax calculations are heavily influenced by the valuation method used. Different methods, such as the transaction value method, the comparable-unrelated-party method, and the customs value method, lead to varying assessed values. Understanding these methods is crucial for accurately predicting the potential tax burden on imported goods. The chosen method directly impacts the total amount of duties and taxes payable, significantly impacting the final cost of the imported product.

The method selected is usually based on the specific characteristics of the imported goods and the nature of the transaction. For example, in cases where the transaction involves related parties, the comparable-unrelated-party method might be applied. Accurately applying the relevant valuation method is vital to avoid potential disputes and ensure compliance with international trade regulations.

Country of Origin

The country of origin of the imported goods plays a significant role in determining import duties and taxes. Different countries have varying tariffs and trade agreements with the importing nation. These agreements can either reduce or increase the tax burden on goods originating from specific countries. For instance, preferential tariffs might apply to goods originating from countries with which the importing nation has a free trade agreement. This can substantially affect the final cost of the imported product and should be thoroughly assessed.

Classification of Goods

The accurate classification of imported goods is essential for determining the applicable import duties and taxes. Detailed product descriptions, including specific characteristics, use, and purpose, are crucial for proper classification. Incorrect classification can lead to inaccurate duty calculations and potential penalties. The correct Harmonized System (HS) code is vital for identifying the appropriate tariff rates. Thorough research and understanding of the HS code system are critical for accurate import duty and tax calculations.

Quantity of Goods

The quantity of imported goods directly influences the total import duty and tax obligations. Higher quantities often result in higher tax liabilities. Import duties are often calculated per unit or per weight, and the total amount owed is directly proportional to the overall quantity of the goods being imported. Accurately determining the quantity and ensuring proper documentation of this quantity are essential components of the import process.

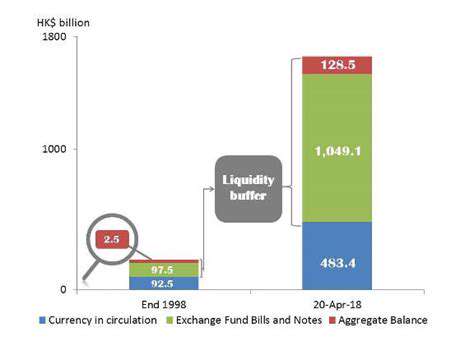

Exchange Rates

Fluctuations in exchange rates significantly impact the final cost of imported goods, and therefore, import duties and taxes. A change in the exchange rate between the importing country's currency and the exporting country's currency can dramatically affect the price of the imported goods. The conversion of the price from the foreign currency to the domestic currency for duty calculation is crucial. A precise understanding of the current exchange rate and its potential impact on the total import cost is therefore essential for accurate import duty calculations.

Trade Agreements and Treaties

International trade agreements and treaties play a critical role in shaping import duty and tax calculations. These agreements often establish preferential tariffs or exemptions for specific goods or countries. Understanding the various trade agreements applicable to the import transaction is crucial for determining the accurate import duty and tax payable. Countries with free trade agreements or other preferential trade arrangements often have reduced tariffs on certain goods from partner countries. Careful consideration of these agreements is vital for minimizing the financial burden of imports.

Import Procedures and Regulations

The specific import procedures and regulations of the importing country can also affect the calculation of import duties and taxes. Compliance with these regulations is essential for avoiding penalties and ensuring a smooth import process. Different countries have varying documentation requirements, customs procedures, and deadlines. Understanding and adhering to these procedures is critical for accurately calculating duties and taxes and for avoiding potential delays or complications during the import process. Accurate compliance with regulations is paramount for a successful and cost-effective import process.

![Best Luxury Travel Credit Cards [2025]](/static/images/27/2025-05/ExploringSpecificCardOptionsfor2025.jpg)

![Best Travel Credit Cards for Lounge Access [2025]](/static/images/27/2025-07/AnalyzingSpecificCardFeaturesfor2025.jpg)